How to activate automated super stapling with SuperAPI

To activate automated super stapling you must assign "SuperAPI Pty Ltd" as an appointed business to access ATO Online Services on your behalf (via API). This appointment is set up via ATO Access Manager, using your MyGovID.

In order to set up the appointment you must have "Principal Authority" or "Authorisation administrator" privileges within the business entity.

Note: These instructions will activate both TFN Declarations & Super Stapling.

Setup Instructions

1: Login to ATO Access Manager

- Login to ATO Access Manager using your MyGovID

2: Select your business entity

- If you have access to multiple companies, select which company you'd like to authorise for Super Stapling and click "Continue".

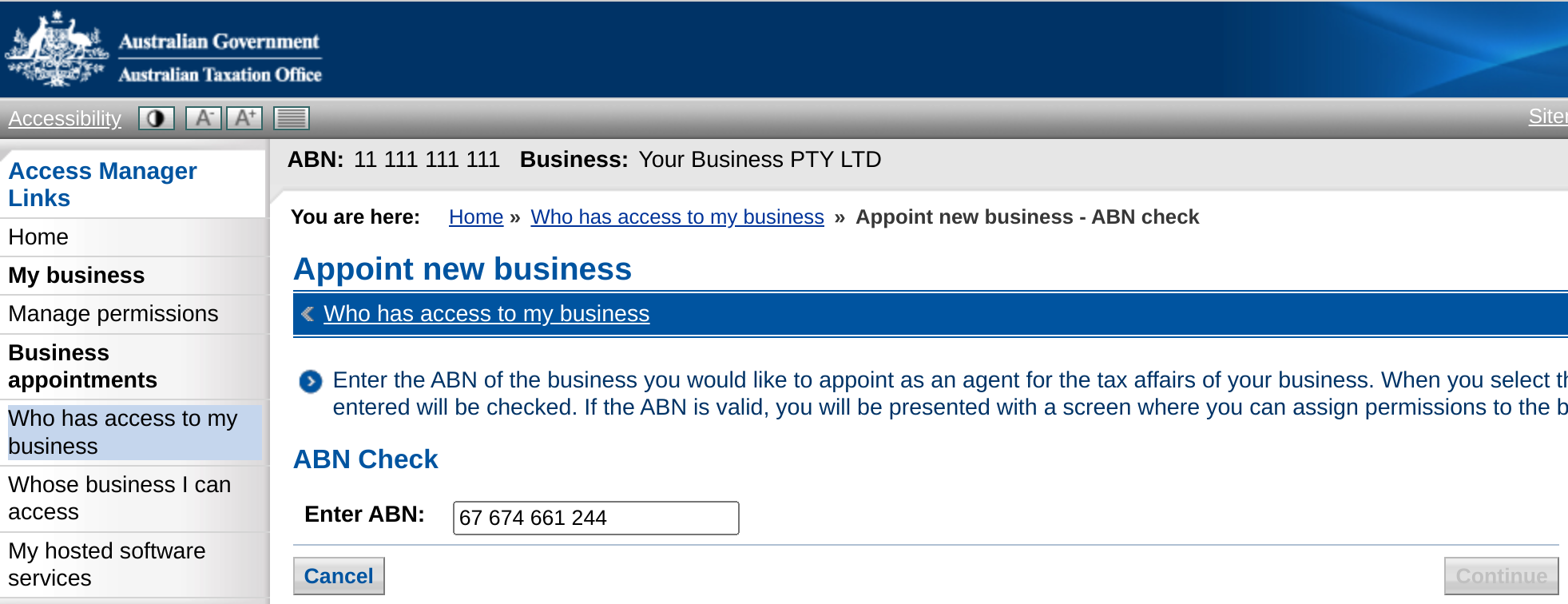

3: Appoint a new business

- Under "Business Appointments", click "Who has access to my business"

- Enter ABN: "67 674 661 244" to appoint "SuperAPI Pty Ltd" as your provider of ATO Online Services

- Click "Continue"

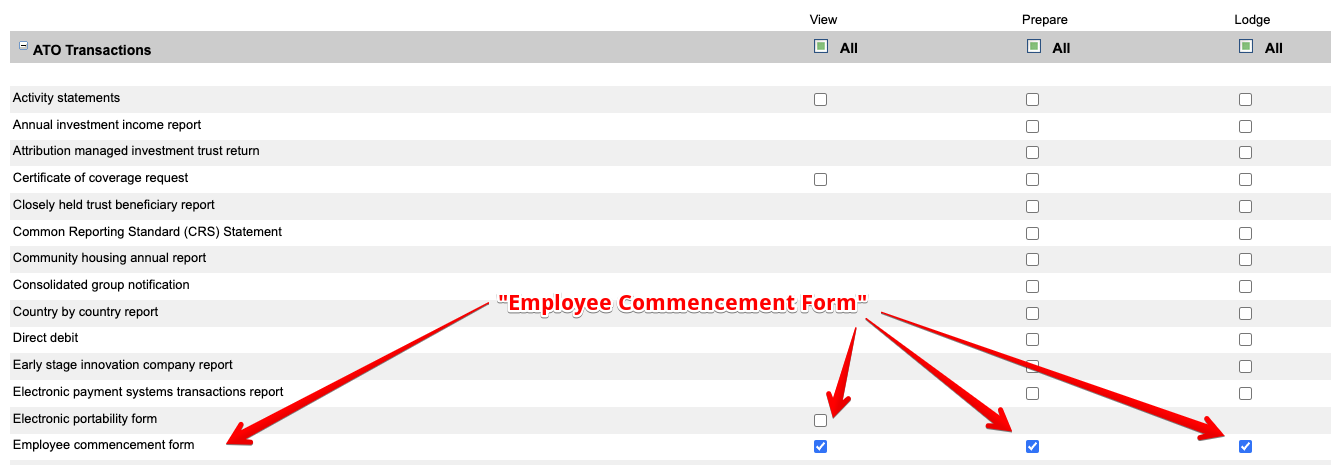

4: Assign permissions

- Scroll down to "Employee Commencement Form"

- Check all three boxes, "View", "Prepare", "Lodge"

- Click "Save"

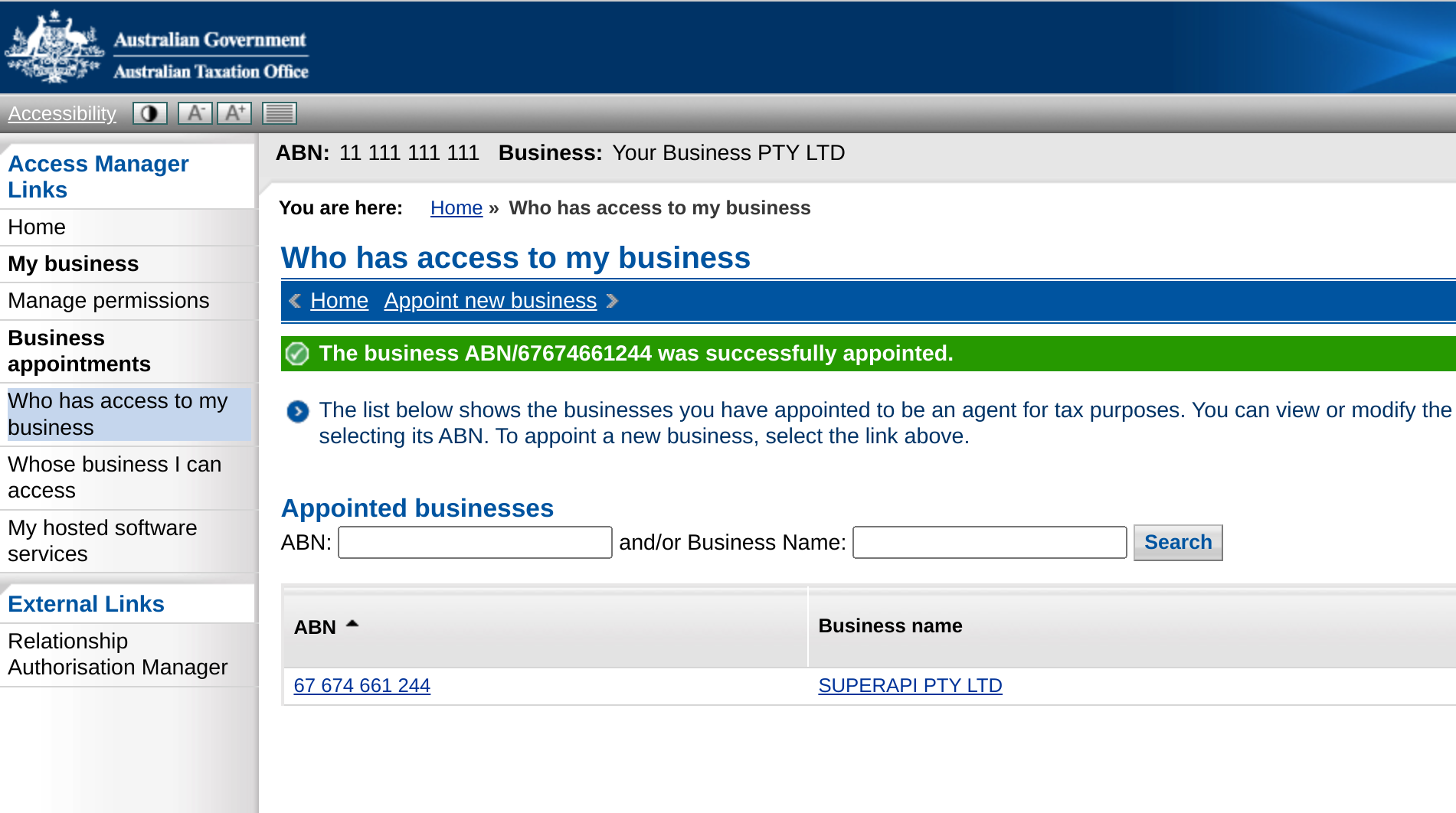

- You should now see "SuperAPI Pty Ltd" under your appointed businesses

5: Success

- You should now see "SuperAPI Pty Ltd" under your appointed businesses.

- To verify that super stapling has been successfully authorised, return to "Employer Setup" and click "Check stapling activation".

- You've now successfully set up super stapling

FAQ: Help activating automated super stapling

Unable to access ATO Access Manager?

If you receive an error when attempting to log in to ATO Access Manager then you do not have the required authorisations. You can log in to the Resource Authorisation Manager (RAM) to view your privileges. To log in to ATO Access Manager you will require the role of "Principal Authority" or "Authorisation administrator". You will also require "Full" level of access to the "Australian Tax Office (ATO)".

Don't have a MyGovID?

If you don't have a MyGovID, you also won't have access to ATO Access Manager (AM), or Resource Authorisation Manager (RAM). You should speak to the owner of the business, finance team or payroll team and determine who has a MyGovID, and access to these portals. Once you have determined who has access, provide these instructions for them to complete.